Also known as profit and loss (P&L) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time. The above example is the simplest form of income statement that any standard business can generate. It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses. While the balance sheet provides a snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year. It’s worth noting that a profitable company as shown in the income statement may not always have positive cash flow.

Similarly, an investor might decide to sell an investment to buy into a company meeting or exceeding its goals. If you don’t have a background in finance or accounting, it might seem difficult to understand the complex concepts inherent in financial documents. However, taking the time to understand financial statements, such as learning how to read an income statement, can go far in helping you advance your career.

- Comparing net sales across different financial periods reveals insights into the company’s sales performance, efficiency, and customer satisfaction levels.

- For example, a customer may take goods/services from a company on Sept. 28, which will lead to the revenue accounted for in September.

- It also helps business owners determine whether they can generate high profit by increasing prices, decreasing costs, or both.

- After taking into account all non-operating items, the bottom line of the company showed $7,000 as net profit.

- Comparing the income statement to other financial statements, like balance sheets and cash flow statements, will give you a holistic perspective on a company’s financial position.

A line-by-line analysis of an income statement

For example, revenue is often split out by product line or company division, while expenses may be broken down into procurement costs, wages, rent, and interest paid on debt. Learn how your business can create and use income statements, along with other financial statements. Following operating expenses are other forms how to file taxes with irs form 1099 of income, known as income from continuing operations. This includes operating income, other net income, interest-linked expenses, and applicable taxes.

The Income Statement vs. the Balance Sheet

Gross profit is the difference between the total revenue and the cost of goods sold (COGS). This margin represents the percentage of revenue that a company retains after considering the cost of producing its goods or services. Accountants, investors, and business owners regularly review income statements to understand how well a business is doing in relation to its expected future performance and use that understanding to adjust their actions. A business owner whose company misses targets might pivot strategy to improve in the next quarter.

Revenue Section

Operating expenses are the expenses the company incurs through its normal day-to-day operations. HBS Online’s CORe and CLIMB programs require the completion of a brief application. The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set corporate tax definition up an account before starting an application for the program of your choice.

It starts with the top-line item which is the sales revenue amounting to $90,000. The illustration above comprehensively shows the different levels of profitability of XYZ Corporation. This is used to fund public services, provide goods for citizens, and pay government obligations. This metric evaluates the efficiency of a company at utilizing its labor and supplies in producing its goods or services. However, it uses multiple equations to determine the net profit of the company. Updates to your application and enrollment status will be shown on your account page.

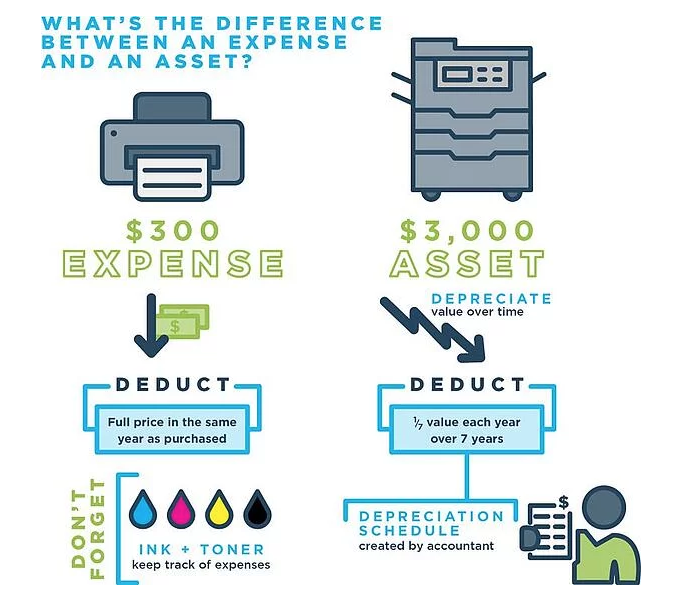

Depreciation in the income statement

Comparing these numbers, you can see that just over 30% of Microsoft’s total sales went toward costs for revenue generation. When you depreciate assets, you can plan how much money is written off each year, giving you more control over your finances. Often shortened to “COGS,” this is how much it cost to produce all of the goods or services you sold to your customers.

Net income or net profit, on the other hand, is the bottom line of the income statement that considers all revenues and expenses, including financial, operating, and tax expenses. It is essential to understand the difference between operating income and how variance analysis can improve financial results net income to assess how effectively the company is managing its resources and whether it can generate sustainable profitability. An income statement is a rich source of information about the key factors responsible for a company’s profitability.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. It can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus. Income statements serve as an indicator of how successful the implemented strategies are and whether there are areas that need improvement.